Today let us think about how people make investments in TON, what they may be missing, and alternative ways of thinking about the opportunities presented by The Open Network.

Prepare for a longish read, grab a drink, cup of coffee, water, or a fruit juice… otherwise at least make yourself comfortable and relax for the ride.

Market Trading

One way that people often invest in a currency is to trade it on a market. These are generally centralized markets such as OKX, with the risks that entails. We talk there of the risks from the market company or exchange service itself, not the additional risks of the trades in themselves. On that note, TON NEWS will be following up on the recent OKX fiasco with the TONCOIN to TON migration.

At the time of going to press today, it is also evident that TON users cannot rely on the official TON Community Telegram channels for accurate information, they still refer to TONCOIN instead of TON and yet it is the TON Foundation which requested OKX to change the token, which has caused users much frustration.

Centralized exchanges thus contain many risks, even before you start trading.

Those who do opt to trade, operate, generally, on the simple principle of “buy low and sell high”, which is how many traders profit on any commodity. They buy at one price, and sell at a higher price.

This does not always work out of course, and often margins are quite low, and thus profits from amount of money that are not very large, are also minimal. With it of course come risks, there is never total certainty on when to buy and sell.

Other options are decentralized finance “DeFi”:

Trading of course always carries risks, and you are reliant upon several factors, your own skills and abilities, knowledge, the technology being reliable, the internet connection, the web servers, emotions, and so on.

In addition, you are up against the professionals, robots programmed to make buys and sells using Artificial Intelligence, insider information and so forth.

It really isn’t something for everyone, and generally people find they win some and lose some, and there is much expenditure learning along the way.

In general you should invest only what you can afford to lose! Much like gambling in a casino however, you can go in with one plan to leave as soon as you incur a certain loss or a certain win, but this rarely translates into practice.

Having lost something, you have a natural inclination to want to win it back. Having gained something you have an inclination to want to gain even more.

Staking and Mining

Only a very brief mention of this, it is not for everyone, and is not necessarily profitable. Even if you “stake” TON in a pool you “only” get some 13% or so profit from your coins that are inaccessible for an entire year, otherwise you won’t make much and are more likely to lose due to the fees of deposit and withdrawal.

People liken staking to putting money in the bank and letting it grow from interest.

HODL

Holding On for Dear Life, putting way your TON and leaving it to grow in value over the years to come is also a strategy that can work, but it has many disadvantages. Here are some of them, which people do not often consider:

You may die before you ever get to use it

You may forget where you put your passwords

You may take it out too early

You may take it out too late

All this time you may not benefit from it

Yes it can make a great gift for anyone, such as your child, for the future.

Philosophical Considerations

Let us take a step back at this point, and ask ourselves if we’re not missing something. Let us ask a few questions and then answer them:

What is a currency

What is the purpose and use of a currency

Will the currency rate increase against another currency benefit us?

If the currency goes up 10 times in value, will it change our life?

Do lawyers ever lose?

Do money changers ever lose?

These should be enough for now, let us take a closer look at each and give some possible answers.

What is a currency

A currency is at least two things, which is why it is called “currency”:

It is current. This means, it is valid, here and now, it can be used.

It is a current. This means, it flows, is in circulation.

If your currency is not current, that is, not in need, no one will want it, you cannot use it.

If it is not in circulation then the above HODL principles apply, it serves no current purpose, and its future is also at risk. There is no benefit until then, and there may never be.

The Prophet Muhammad warned about holding money, instead of circulating it, and all religions encourage the giving, for those that give, shall receive.

The Holy Quran followed by much of mankind as Divine Guidance even puts usury as the greatest of sins creating the worst problems for humankind.

As usury hinders part of the productive human power, it prevents money from circulation. Money circulation to society is exactly like blood that circulates in the body, and water that runs in orchards. Preventing money from circulating has very bad effects on the society just like arteriosclerosis or the blocks that prevent water from running. - Source

What is the purpose of a currency

It is to facilitate trade, the fulfillment of needs, and to ease exchanges.

Hoarding, and trying to make money out of money by speculation, isn’t healthy.

Will the currency rate increase against another currency benefit us?

What matters is what you use. If you cannot use Zimbabwe Dollars in Mongolia, then the rate matters little, unless you can exchange it.

As stated earlier, people speculate on currency variations.

What matters surely if the actual currency you use: do you have enough of it, is it in circulation, can you receive it, be compensated with it, spend it for your needs?

If the currency goes up 10 times in value, will it change our life?

No, and this is something most people again do not understand. Let us give some actual examples.

Write down on a piece of paper, or remember in your mind, an exact amount of your currency that you can afford to lose, and that you can invest.

Maybe you said 10 TON if you are poor, maybe T100, T1k, T10k, T100k, or One MegaTON (1MT) or 1,000,000 TON if you are wealthy.

Now, let us say that the value of TON goes up and by the end of the year is 10 times higher, against your currency, than it is now. This is not an unrealistic expectation. It could be less, or more. Let us say it goes up 10 times in value.

Now, answer these questions:

Were you sure enough it’ll go up 10 X so you held on to it until then?

Did you sell it when it doubled in value, or 3X, 4X, 5X?

Let us say you had an iron will, and held on to it. So, multiply your original investment now by 10. If you were poor, your 10 TON is now 1000 TON. If you were very wealthy your 1MT is now 10MT. Convert these numbers back to your local currency, if you are not familiar of the size of TON.

Now, answer this questions

Did the new amount of money, 10X your investment, change your life?

Now, do you see why the answer is NO?

If you were poor, you are still poor, only (temporarily perhaps) less poor

If you were rich, you are still rich, only somewhat richer than before.

Again let us visualize this in the real world:

If you are poor, the $10 you could spare, which is now $1,000, will get you some more food for the coming year, depending on inflation. But it won’t make you rich.

If you are a billionaire and invested $1 billion in TON you now have $10 billion.

You can buy some more yachts, another aircraft, some more politicians. But did it change your life? You are still a billionaire, it didn’t make you a trillionaire.

So isn’t there a better way to use TON than to invest in this manner? Let us think.

Do lawyers ever lose?

Reflect before you answer. You may say yes, of course they lose some, they win some. Yes, this is true, if it concerns the legal cases themselves, and their clients certainly win or lose. But the lawyers themselves, never lose. Not unless they are very charitable. They always get paid, and they get paid whether their clients win or lose. They are paid for their time, so in this sense, they never lose.

Would you rather be a client of a lawyer, or a lawyer?

Do money changers ever lose?

Again reflect on this. Does the money changer care whether the rate of TON vs USD is going up or down? Does he win some and lose some depending on the rate? Unless he is hoarding a lot of cash, the answer is no, he always wins.

Every customer that comes in the door, will pay a commission. The money changer just checks the rate at that moment, and changes the money, charging his commission. He makes money from these commissions, which cover most changes in the value of his stock of currencies. Every single time. Every client.

We are not suggesting that a money changer is any better job than a usurer. Nor are we encouraging you to become a lawyer. The point is, they know that speculating on outcomes to win or lose some is not nearly as reliable an income as charging every person that comes through the door, and taking their money.

Are you still with us?

If you have read this far, you may now be forming a picture of what we’re getting at. It is not the best way to gain benefits by either holding TON, speculating on TON, saving TON, or gambling on TON.

So what would be better ways?

What if you can earn money, that you otherwise would not be able to earn?

What if you can save money, spending that on what you otherwise wouldn’t have?

Many people have got skills, knowledge, time or assets that aren’t so easy to dispose of in the existing official economy:

red tape to set up a business,

taxes that are sometimes even paid in advance on estimation,

license fees, documents and regulations,

charges that are geared to preventing small to medium sized businesses getting off the ground, but benefit the larger monopolies.

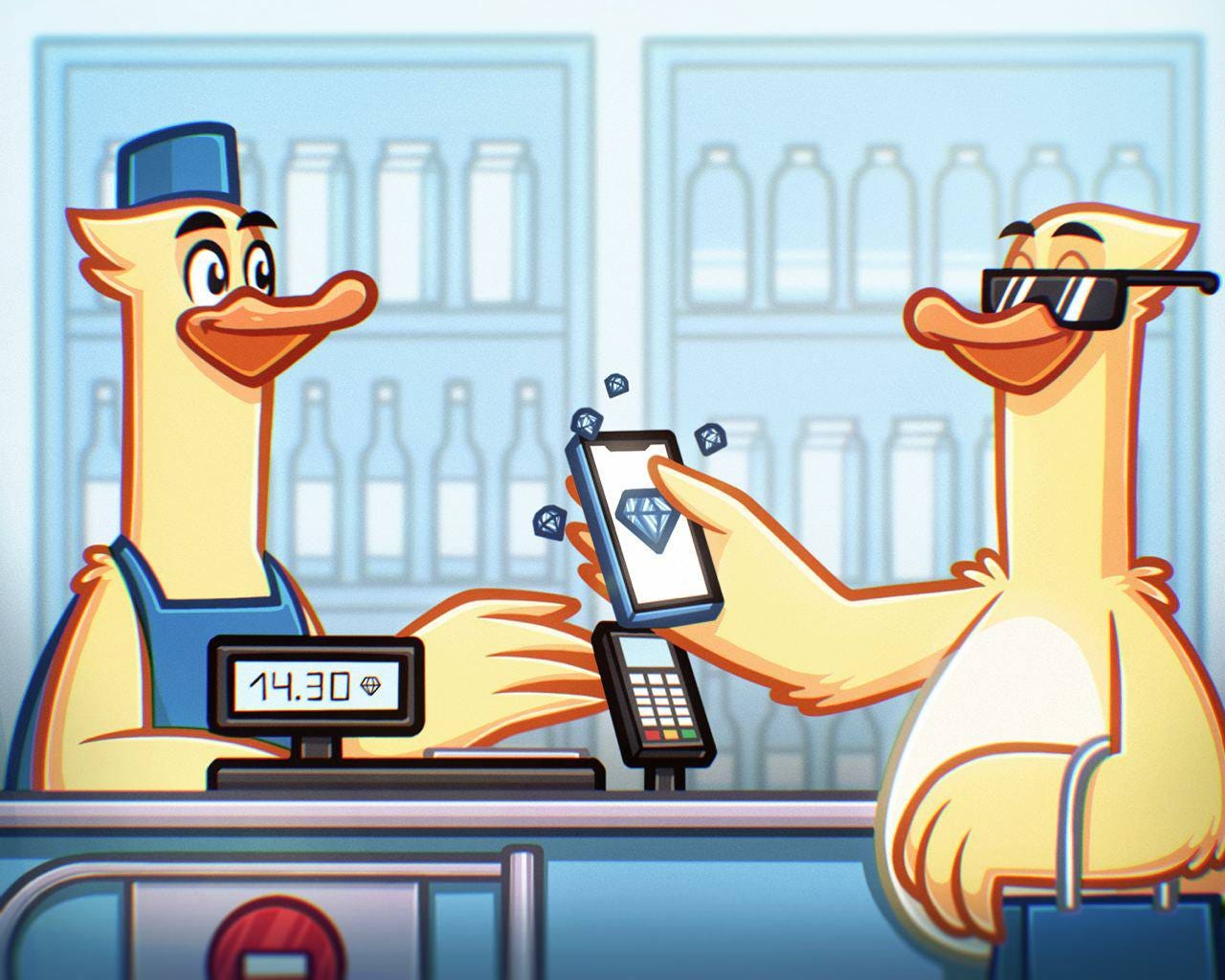

This is exactly why cryptocurrencies are so popular in some African and Asian nations where people are very entrepreneurial, they’re not lazy. Roadside hair dressing or cutting, food vendors, all manner of trades and goods are paid not into a bank account, which many do not even have, but from mobile phone to mobile phone, into a cryptocurrency wallet.

The same way people in Europe scan their goods at checkout and make a payment with a credit card or mobile phone.

If they had to go through all the bureaucracy, would they be working and flourishing, earning enough to cover their own needs? They’d be suffering.

Instead they can carry out their small businesses, earn currency, such as TON, and then spend that currency on what they need, effectively using it as intended, as a CURRENCY.

Also think what happens if you can spend your TON on products and services that are otherwise costing you other currencies?

Instead of worrying about changing TON to Euro, Dollars, Rial, Rubels, Baht, Rupees etc, you can simply use the TON to buy services and products directly.

All this requires TON to become a currency, that is, current, and circulating.

This is exactly what will happen if millions of people start using TON.

The services and products will be available in market places.

There is one project that TON NEWS is aware of that is working exactly on those principles, and this could be a much better investment for those wanting to get an ROI of up to double in the shorter term and thus worth keeping an eye on.

These are the types of ideas that come out in part from needs to be fulfilled, challenges to be overcome, and opportunities that present themselves, with TON.

Stay tuned to TON NEWS for more such insights, and now also a new button:

EQAs9dPoqn4FRfV7bIeP2rUuFyRPPWviDbv2obDC4l_x4VQQ

You can send any amount from 0.000000001 TON to 1000000000.0 TON according to what you think this article was worth to you, and you can afford.

It is better to send a little than nothing, it won’t change our life, but everything does help to make it easier, so that we can do more! Thank you for reading!